Features of AI Agents for Loan Origination

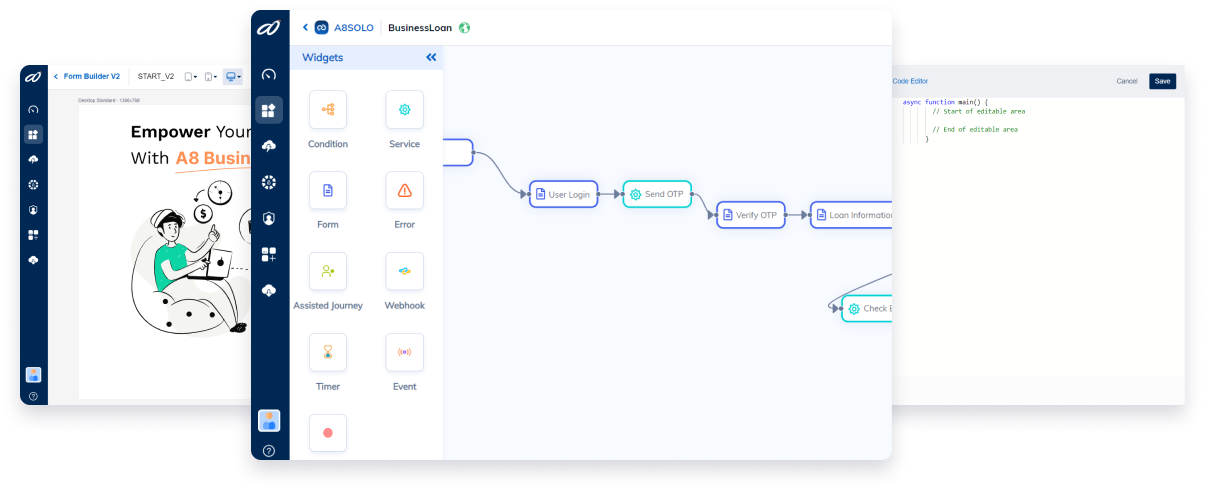

Autonom8’s platform streamlines your lending workflows with AI agents that verify, assess, and act—fast and securely.

Document Data Extraction

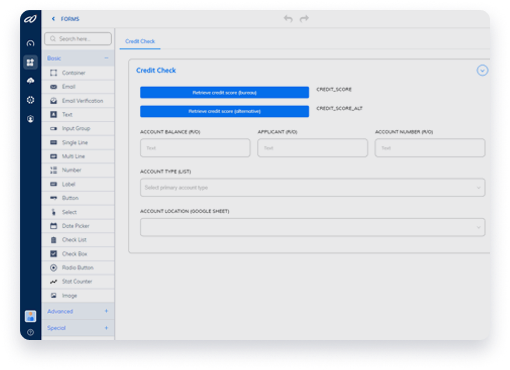

Credit Bureau API Integration

Rule-Based Eligibility Engine

Auto-Generated Approvals & Emails

AI-Generated Loan Summary

Loan Agreement & E-sign Integration

Compliance Monitoring

Realizing use cases across the largest banks worldwide

IndusInd Bank

A top private bank in India, using Autonom8’s low-code platform to rapidly roll out digital customer journeys. They have leveraged our platform for initiatives in retail loans and branch digitization, accelerating their digital transformation roadmap.

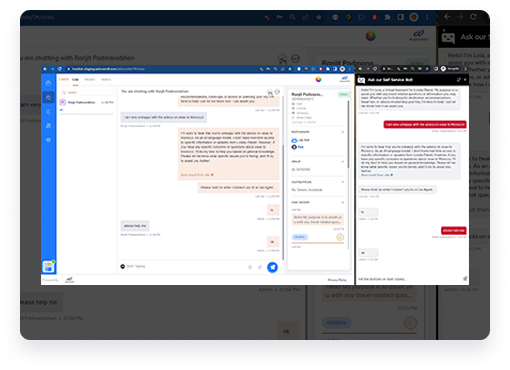

HDB Financial Services

we partnered with HDBFS to reinvent their loan onboarding. They’re now able to adapt to customer insights faster and offer a seamless self-service loan application on their website and app. “Digitization is core to our strategy. Our online platform provides seamless credit access promoting financial inclusion,” notes Venkata Swamy, CDMO of HDBFS, highlighting how Autonom8 underpins their growth strategy.

Kinara Capital

An MSME lender that digitized end-to-end loan management with Autonom8. From initial field sales data collection on tablets to backend loan processing, Kinara’s team worked with us to configure workflows that reduced manual data entry and eliminated paper. The outcome was a faster turnaround for their entrepreneurs – loans that used to take 10-14 days are now done in 3-5 days, helping small businesses get funding when they need it.

Mahaveer Finance

A vehicle finance company (NBFC) that embraced Autonom8 to hyperautomate their loan processing (as cited above in the CEO’s quote). By automating document verification and credit assessments, they significantly reduced processing times and manual work, giving them a competitive edge in customer response.

Our Clients

Powering financial institutions with secure credit decisioning

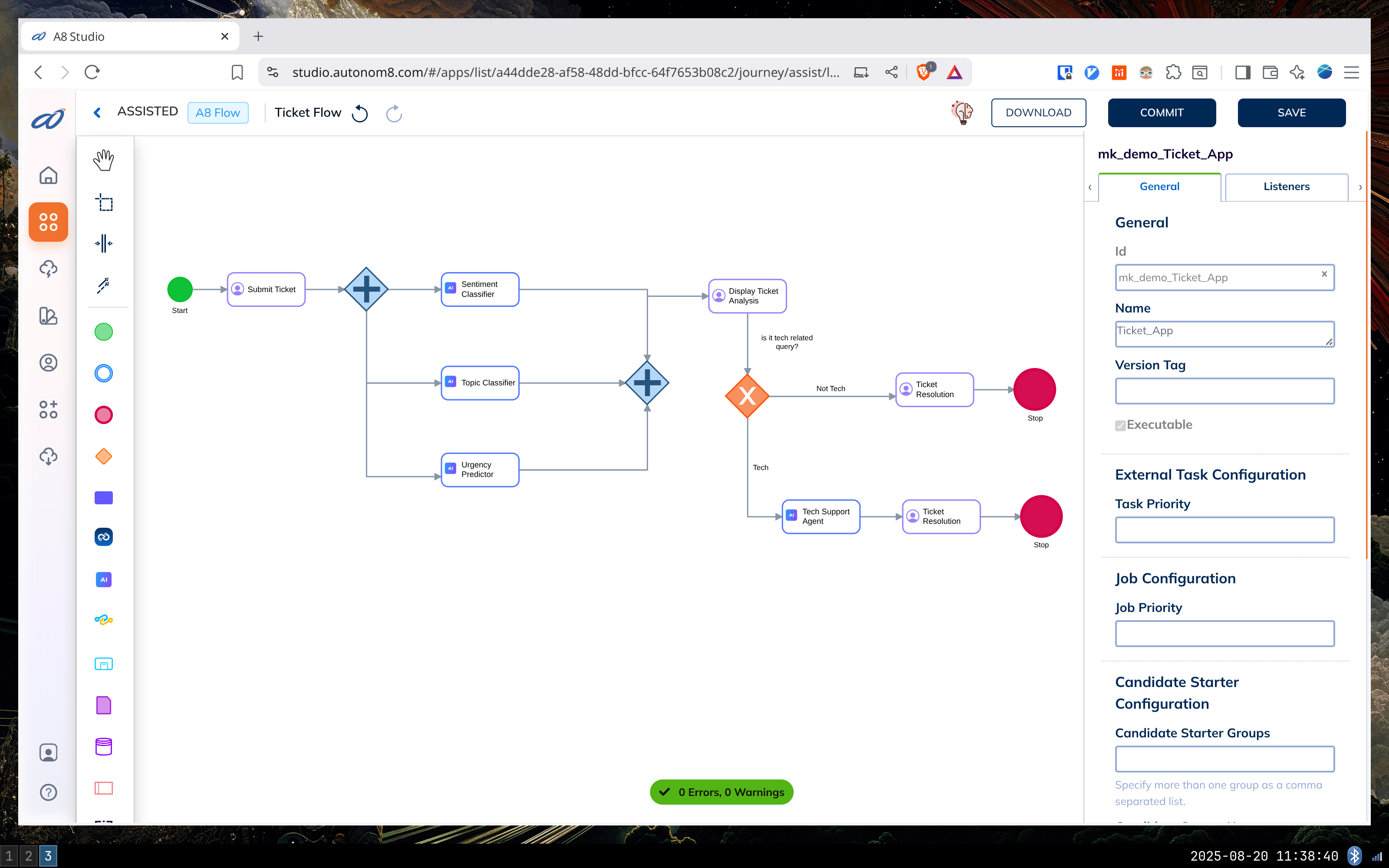

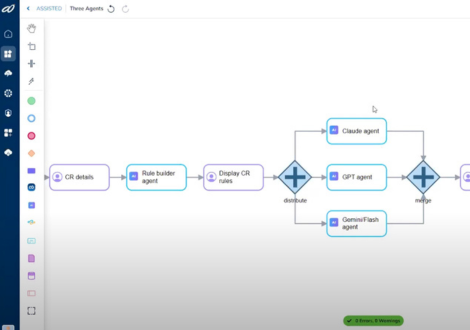

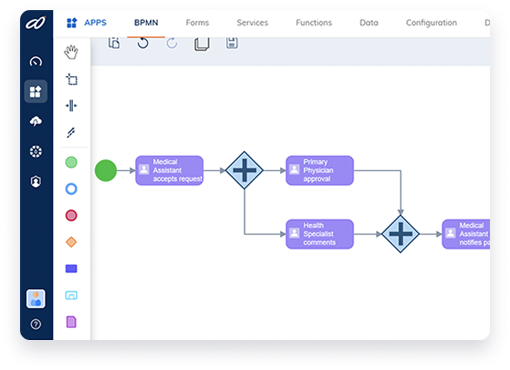

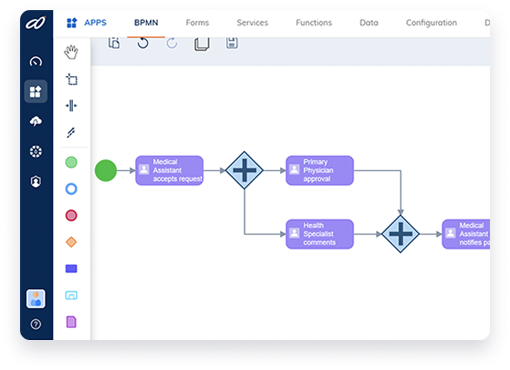

Automated Verification & Underwriting

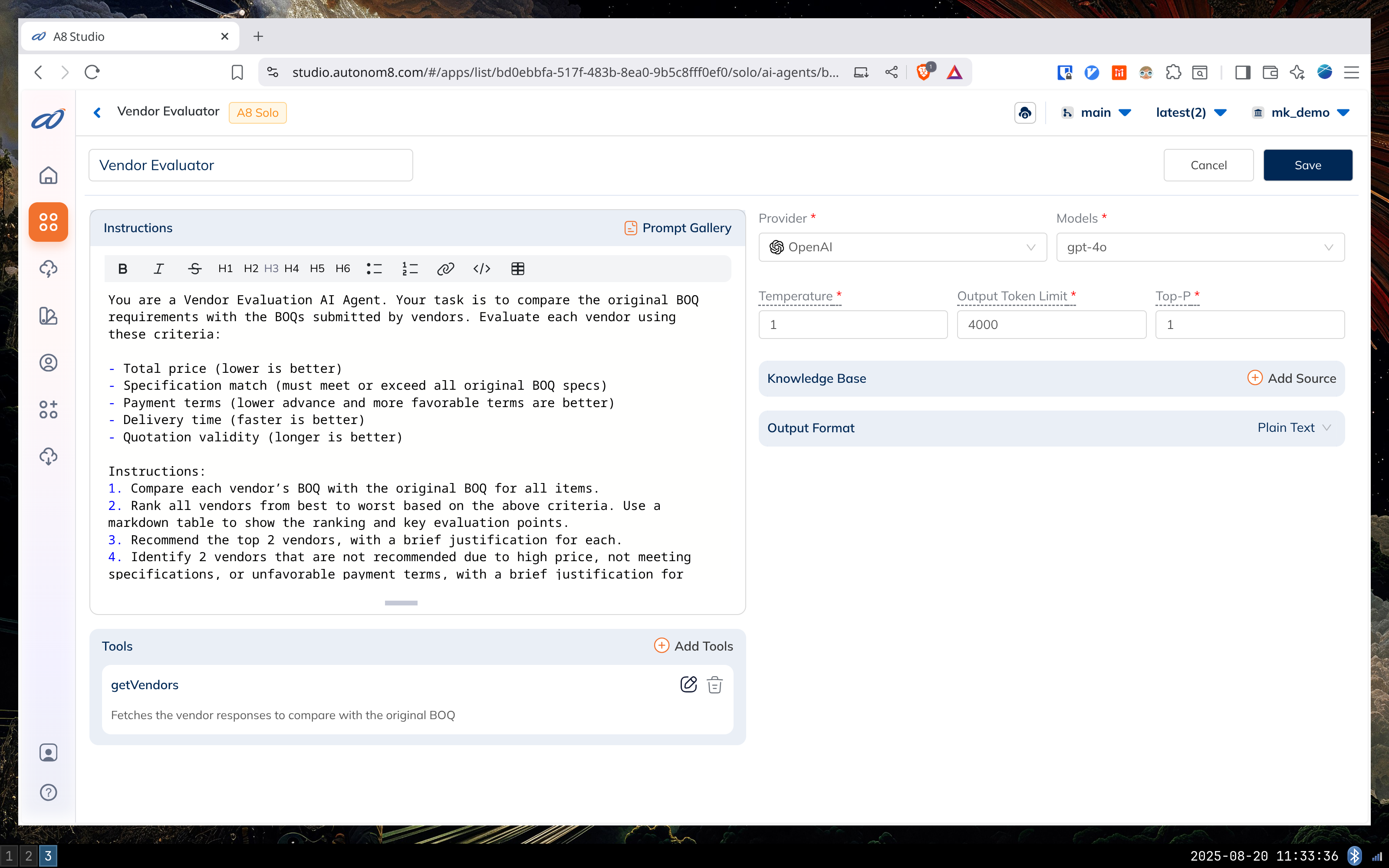

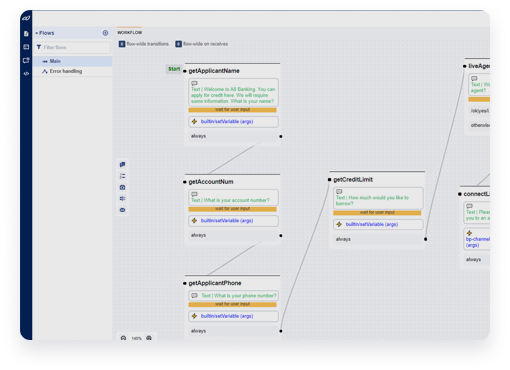

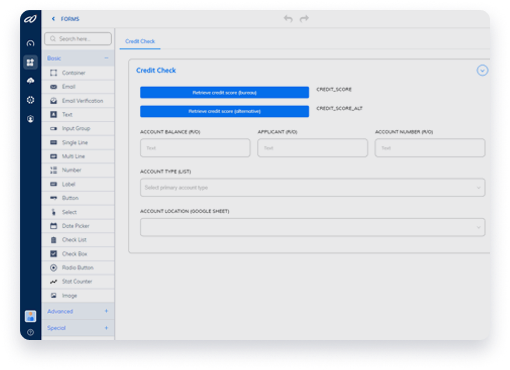

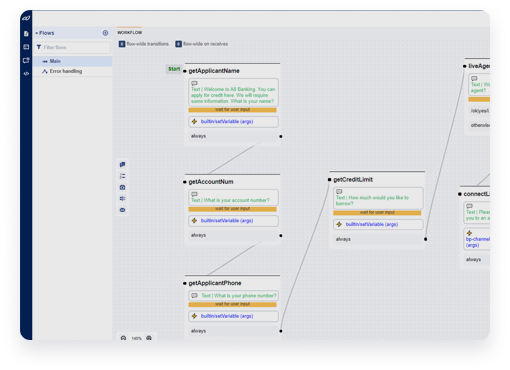

Autonom8’s agentic workflow takes over the back-office checks, automatically fetches credit scores, query databases (like CIBIL or FICO), and apply your business rules to assess eligibility. Income proofs and bank statements are analyzed with AI (our A8iQ module using ML to extract key figures). Frauds or AML flags are screened through integrated watchlist services. All this happens within a few seconds to minutes, drastically shortening what used to be a week-long process.

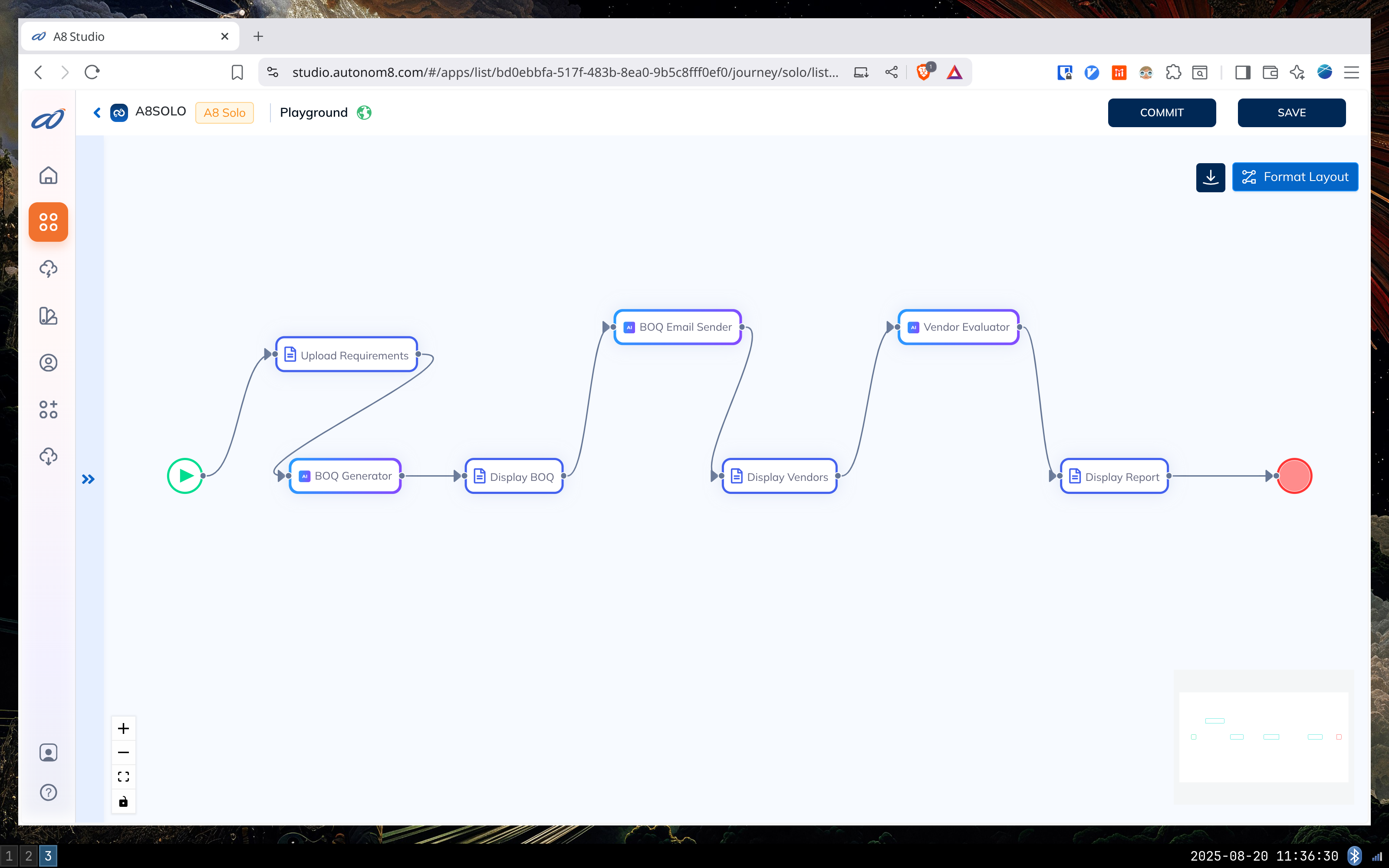

Credit Decisioning & Disbursement

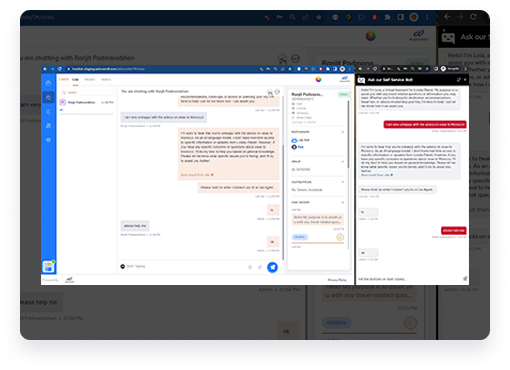

With the heavy lifting done by AI, your credit officer just receives a concise summary (generated by the AI agent) highlighting the applicant’s profile, risk flags, and a recommended decision (approve/decline or refer). They can adjust parameters if needed and hit “approve”. Autonom8 then triggers the next steps: generating offer letters or loan agreements (auto-filled), e-sign integration for customer signature, and instructing core banking systems to disburse funds. Loans that took 5-7 days are now often completed in a single afternoon.

Branch Operations

In branch banking, Autonom8 workflows integrate with systems like Finacle, Core Banking, or CRMs to automate tasks like updating customer details or processing service requests logged at the branch.

Compliance Monitoring

Agentic workflows can assist compliance teams by automatically flagging suspicious patterns. For example, if a flurry of transactions triggers AML rules, an Autonom8 workflow can compile the case, check against sanction lists, and even draft a SAR (Suspicious Activity Report) for review. This augments your compliance officers, ensuring nothing slips through and that they spend time on analysis rather than number-crunching.

Media Mentions

Success Stories

Unlock intelligence in every step of your customer workflow.

Here’s how our customers did it with our robust Autonom8 platform.

Read our reviews on G2 Crowd

Read our reviews on G2 Crowd