Customer background

Market leader in vehicle finance had challenges with existing process: combination of paper + app driven process. Key issues were low salesforce productivity, poor user experience, compliance issues and limited ability to make process changes.

Process Coverage

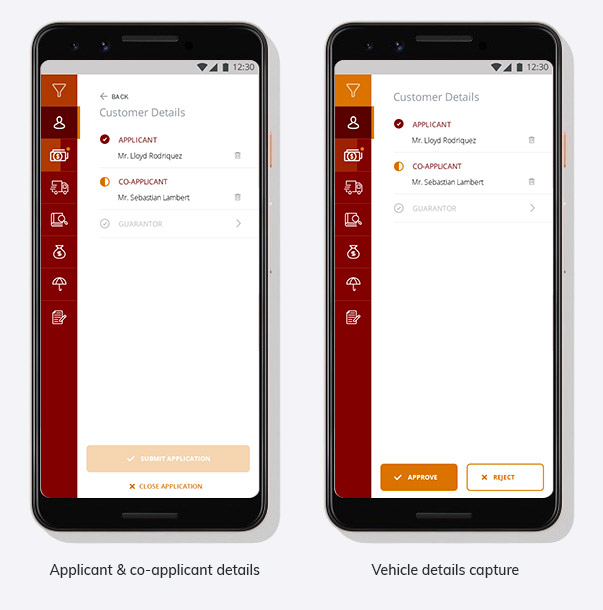

All field processes from lead to submission for a total of 500+ fields (customer details, credit analysis, field & vehicle inspections & dealer payouts). Identity documents were to be parsed and 20 integration points were to be worked on with enterprise and external services.

Key design principles:

- Reimagine process to create single view & execute complex rules – with ability to manage multiple borrowers & vehicles

- Ensure best-in-class user experience with ability to handle low mobile network environments

- Flexibility to accommodate flow changes and engage with variety of external integrations

- Implementation within 60 business-days

- Minimize IT involvement from customer to ~0.5 FTE around interfaces

Approach

- Autonom8 configured the platform with weekly review of UX and business rules, with a variety of client stakeholders

- The product was hosted on cloud to interface with client’s Loan Management System

Benefits

4x

Reduction in cycle time.

50%

Lift in efficiency

15%

Rise in customer satisfaction.Value delivered

- Effort reduction of 60-65% across the sales agents and back-office.

- Cycle time averaged at 24 hrs (well below SLA of 48-72 hours)

- Improved compliance posture (with time and geo-stamping)

- Greater flexibility and agility with weekly enhancements

- Significant improvement in agent delight and end-user experience

- Moved a lot of the back-office activities to front office – leading to better loan closures, ability to upsell / cross-sell

- Ability of IT to respond faster to Business needs.