A complete overview of Intelligent Automation role in Banking

Uniphore Has Announced the Intent to Acquire Autonom8 to Enhance the Capabilities of Business AIView Announcement

Is Your Bank Ready for Intelligent Automation?

Imagine waiting hours for loan approval or standing in long queues to complete simple banking tasks. Sounds frustrating, right? This has been a reality for many customers in the banking industry until now. With the rise of intelligent automation, banks are evolving to provide faster, more accurate, and seamless services.

Intelligent automation continues to evolve and wow the world with its use cases across verticals! All kinds of industries have embraced the technologies surrounding intelligent automation to be more efficient and enable scalability.

According to a report by Accenture, the adoption of intelligent automation technologies in the banking industry could result in annual cost savings of up to $70 billion by 2025. This staggering statistic highlights the immense potential of intelligent automation in revolutionizing banks’ operations.

Intelligent automation, as you may recall from our detailed overview post, is the use of advanced technologies, including robotic process automation (RPA), artificial intelligence (AI), machine learning (ML), and natural language processing (NLP), to automate processes, reduce costs, and enhance efficiency. Intelligent automation combines the strengths of humans and machines to perform repetitive, manual, and rule-based tasks while also providing insights and decision-making capabilities.

In the following paragraphs, we’ll talk about the use cases of intelligent automation in a sector that has greatly benefited from its integration – banking. We’ll explore the benefits of intelligent automation in banking and how it’s changing the game for both customers and financial institutions. So, let’s dive in!

Related article: The Role of Generative AI in Loan Origination System

Intelligent automation (IA) combines artificial intelligence (AI), robotic process automation (RPA), and machine learning (ML) to automate complex processes. By reducing manual tasks, IA frees up time for more strategic initiatives while improving speed and accuracy.

In banking, IA is revolutionizing everything from customer onboarding to risk management, providing both customers and banks with faster, smarter solutions.

For years, the average customer’s experience at banking institutions involved long lines and dealing with frustrating customer service personnel. Banking was once an immensely labor-intensive industry – when the processes were slow, cumbersome, and manual. However, with the advent and integration of intelligent automation and other handy pieces of technology, we can confidently say that tech is on a steady path to revolutionizing the banking industry!

Banks have begun embracing intelligent automation to digitize and automate their processes, enabling them to deliver services faster, with greater accuracy, and at a lower cost. From customer onboarding and loan processing, the way banks operate provides unprecedented levels of efficiency, speed, and agility.

This article will explore the importance of intelligent automation in banking, its applications, benefits, challenges, and future trends.

The banking industry faces several challenges, including

These challenges have led to the need for digital transformation in the banking industry, with banks embracing technology to drive efficiency, reduce costs, and enhance customer experience.

By integrating new technologies such as intelligent automation and hyperautomation in banking, banks are leveraging intelligent automation to automate mundane tasks, streamline operations, and enhance the customer experience. The possibilities are endless, from chatbots that can answer your questions instantly to automated loan approvals.

Intelligent automation is crucial in driving digital transformation in the banking industry. By automating processes, reducing costs, and enhancing efficiency, intelligent automation enables banks to provide better customer experiences, increase operational agility, and improve risk management.

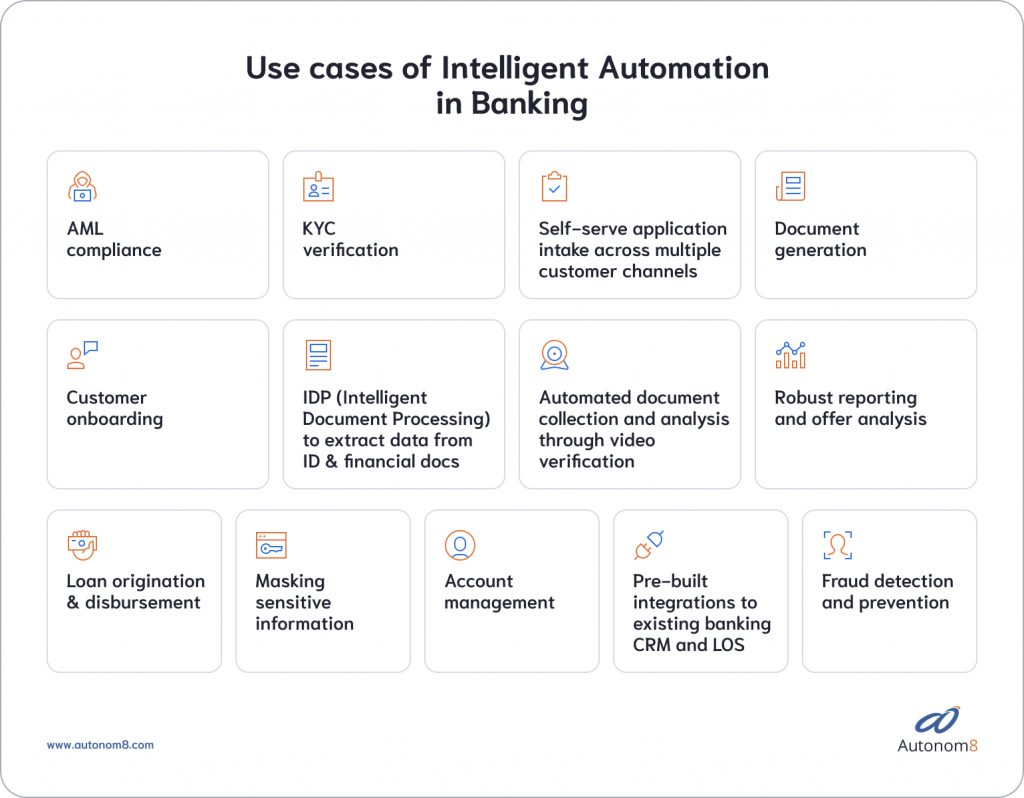

From automating customer-facing tasks like account opening and loan applications to automating internal processes like compliance and risk management, the use cases of intelligent automation in banking are numerous. Here are a few more –

Financial enterprises can use intelligent automation to automate the account opening process, reducing the time and effort required to onboard customers. This process could include automating data collection, document verification, and KYC (Know Your Customer) checks.

IA can help banks manage customer accounts by automating routine tasks such as balance checks, account updates, and account closure requests.

Banks can use intelligent automation to create self-serve application intake processes for customers across various channels, including online, mobile, and in-branch.

Intelligent automation can streamline the KYC verification process by automating data collection, document verification, and risk assessments.

Intelligent automation can help banks comply with anti-money laundering regulations by automating, detecting, preventing, and reporting suspicious transactions.

IA can detect and prevent fraud by creating a baseline safe zone for specific application data and flagging patterns outside that safe zone. Based on predetermined thresholds, applications can be flagged and alerts generated.

Intelligent automation can automate document collection and analysis by using video verification, which enables customers to submit documents remotely and have them automatically verified.

Banks can use intelligent automation to extract data from ID and financial documents, reducing the need for manual data entry.

Intelligent automation can mask sensitive information to protect customer privacy and ensure compliance with data protection regulations.

Intelligent automation can streamline the loan origination process by automating data collection, credit risk assessment, and document verification tasks. Disbursement of loans can also be automated, reducing processing time and costs.

Banks can use intelligent automation to generate loans and other essential documents, reducing manual effort and improving efficiency.

IA can be integrated with existing banking CRM (Customer Relationship Management) and LOS (Loan Origination System) systems, enabling banks to streamline processes and improve data accuracy.

IA can also build credit risk models and identify a band of low credit risk for an applicant. Based on this, if the applicant qualifies for a higher loan, organizations can carry out upselling. This also enables banks to provide robust reporting and analysis.

Intelligent automation offers several benefits to the banking industry, including improved efficiency and productivity, enhanced customer experience, cost savings, reduced errors and fraud, and real-time insights and decision-making. By automating processes, banks can reduce manual errors and increase productivity, resulting in cost savings. Intelligent automation can improve customer experience by providing faster response times and personalized services.

Autonom8’s work with BFSI enterprises has successfully streamlined numerous companies’ customer-facing and back-office workflows, allowing them to focus on their customers solely! Stakeholders have appreciated how our low-code platform enables rapid creation & deployment of automated customer journeys that can cut administrative costs and elevate your banking experience.

Intelligent automation can significantly enhance banking platforms by improving agent performance. To do this, organizations can define key performance indicators such as the number and value of loans, and IA can model the behavior of top-performing agents. This model can then be applied to retrain or reschedule underperforming agents. Additionally, real-time decisions can make loan agent schedules autonomous and dynamic, adjusting based on incoming information, such as new leads in the vicinity. Financial enterprises can streamline processes and improve overall efficiency by automating customer-facing and internal enterprise workflows.

This significant transformation within the industry has resulted in the increased use of digital platforms, changing customer behavior, and heightened competition. We believe that intelligent automation will continue to transform the banking industry, driving innovation and growth while addressing the challenges banks face. This is why banks must embrace intelligent automation to remain competitive and meet customers’ changing needs.

Banks must take a proactive approach to digital transformation and embrace intelligent automation to remain competitive in the banking industry. By leveraging intelligent automation solutions, banks can reduce costs, enhance customer experience, and manage risks effectively, leading to growth and innovation. With the increased use of digital platforms, banks leverage intelligent automation to streamline their processes, enhance customer experience, reduce costs, and remain competitive.

Intelligent automation is present and future! Automate customer-facing and internal enterprise workflows. Intelligent automation is transforming the banking industry by driving digital transformation and enhancing efficiency. Banks must address challenges and considerations when implementing intelligent automation solutions.

If you’re interested in and would like to dive into learning about the top intelligent automation trends we have predicted for 2023, please stop by our other informative blogs on intelligent automation.

Fill in your details and our executive will get in touch within 48 hours

Fill in your details and our executive will get in touch within 48 hours